05.12.2019

Draft article prepared jointly with Sergey Lonchakov, Robonomics platform architect, Airalab team

“Sic possum!”[i]

The world if finetuned “thusly”, the way for us, the observers, to emerge and make observations including this, anthropic principle somewhat trivial observation. And our planet energy balance is not an exclusion. It implies that part of the light energy from the sun is converted into carbohydrate chemical energy for the organic matter to be eventually stored in the form of carbohydrate fossils. This process is unalienable part of the energy balance of the planet and of the aforementioned anthropic principle. When “the observers” started to release this energy millions and billions of times faster than the natural process of conservation through extraction and combustion of fossil fuels, they have breached the balance and the very conditions the life emerged, and humanity exist in. There is no mystery, or doubts, or plots in the simple inference that extraction and combustion of hydrocarbon fossil fuels are extremely harmful and deadly threatful. There is doubt that fossil fuels now can be considered as a common resource at all. They are the energy conservation cushion that should grow but not teared apart by transnational corporations protected by the governments.

In general, exploitation of fossil fuel happened as a result of economic transaction, trading what was perceived as infinite benefits of fossil fuel powered virtually limitless energy for what seemed to be mere time, efforts and technologies expenditures, as consequential negative costs were excluded from considerations entirely.

We would have to admit though that technical progress is a non-for-profit phenomena. Knowledge, curiosity for some of us is much more powerful motive than improvement of conditions, greed or even strive for happiness. A human being would always try something new he invented and designed even harming himself and conscious of the threats and risks to the others. Neuropsychic efforts are not always part of transaction costs. In the act of creation, they are a tempting stimulus one cannot resist. And no pleasure can be compared to the joy of creational achievement. “Yes, I can” is an ultimate motive in itself. That’s what probably moved those people, who made first steam engines and locomotives run and no one would blame them for firing coal and for famous “damage by fire caused by sparks from steam engines”. Like gaming, creation is a specific and peculiar case of acting, not aimed at an improvement of conditions.[i]

But when it became trivial and not an act of creation, invention, or discovery, it is either about “improvement of conditions” or about “making money”.

To be fair, making money is also not always about improvement of conditions or about greed. Turns out that it is also a specific and peculiar act that may be a case of gambling excitement, “passionarity”,[ii] or of a “yes, I can” motive (so to say “posseonarity”[iii]), or aimed and motivated by others’ defeat and loss, or by Protestantism motives. The more one tries to identify universal human motives and define rational and calculable economic models, the more evident is futility of these endeavors and there are too many specific and peculiar cases.

The one assumption we make for the harm and damages to the planet, to humanity problem is that agents or an agent to the transaction with a “making money” motive is liable for all direct and consequential harm and damages known to be, and for offsetting and compensating it entirely.

There seem to be two possible principle solutions within this context, either to make those liable pay for remedies (positive offsetting and mitigation outcomes) or to rely on considerate members of human society to pay for remedies expecting contingency proceeds or not.

The first solution requires disruption of a round-up defense of self-interests of the establishment. The second requires mechanism of direct and trusted participation with contributions in the activities of those who actually do something positive. And here the task is to create a direct peer-to-peer trusted ecosystem and main barrier is to dodge presumption of guilt induced for any out of their control cases by the governments.

Solution one: Peer-to-peer settlement of claims for environmental mitigation and damages on blockchain

The demand for carbon credits and other environmental mitigation market instruments is a catastrophe. It is mainly driven either by compulsion or by corporate PR or tax motives behind non-transparent closed-door deals veiled by green dressing, green labels and brands. Volume of voluntary offsetting of environmental footprint by individuals is a trifle. Which is understandable as it is common for the voluntary offsetting programs to buy out carbon credits in the developing countries for pennies and resell them as offsets at the prices, which are times and tens of times higher. Some of Karl Marx’s observations were probably correct: ”300 percent [profit], and there is not a crime at which [the capital] will scruple, nor a risk it will not run, even to the chance of its owner being hanged”.

Apart of dominating regulatory (administrative) and Pigouvian approaches (approaches that are not exactly solutions) to environmental issues, new institutional economics and Austrian economics provide for conceptual basis for peer-to-peer decentralized solutions to environmental mitigation and damages problem either through direct settlement or litigation over common resources disputes. From the point of view of peer-to-peer ideology, settlement is preferable, but it still should be enforced by real capacity of the claimant to proceed with litigation. Full costs included into and covered by environmental litigations are huge, litigations are expensive and taking into account multimillion budgets of the respondents, which often are transnationals and governments, outcomes are largely but sadly predictable.

The Climate Change Litigation of the World database includes hundreds court cases across dozens national courts and the numbers are rising. Those include claims in opposition of climate action, for deregulation, granting licenses to fossil fuel-based projects etc.

Corporations are the single most represented group of plaintiff; they bring 40 per cent of cases to court, 90 percent of which are to overturn administrative decisions made on the basis of climate change to deny a license (e.g. for a coal-fired power plant or water extraction); and to challenge allocation of allowances under emissions trading schemes or governmental schemes (e.g. for production of renewable energy). Those are not the cases, where blockchain peer-to-peer solutions and facilitation are needed. These solutions and facilitation and enforcement are needed for the communities, especially in the climate change vulnerable areas, for individuals to protect their interests and the interests of the ecosystems, humanity and the planet.

In an early test case filed in 2008, an Alaska Native village sought to make energy companies pay for its relocation, which caused the disappearance of its protective barrier of sea ice. A United States District Court judge, dismissing the case, wrote, “There is no realistic possibility of tracing any particular alleged effect of global warming to any particular emissions by any specific person, entity, group at any particular point in time.”

In 2015, 900 Dutch citizens, represented by the Urgenda Foundation, took their government to court to cut greenhouse gas emissions. It was the first time a group of citizens sued their own government over climate change action — and they won.

The lawsuit resulted in a Dutch court ordering the government to cut greenhouse gas emissions nationwide by at least 25 percent by the year of 2020 (compared to 1990 levels), forcing it to take further measures against climate change.

In Juliana v. United States of America (2015), the US government was sued by 21 young plaintiffs on the grounds that it has failed to protect the right to life, liberty and property of young people by promoting and subsidizing the use of fossil fuels despite knowing their effects. The claim has survived multiple applications for dismissal as well as the addition of defendants and even the substitution of current US president Donald J. Trump for then US president Barack H. Obama, as originally filed.[iv]

In 2015, University of Waikato law student Sarah Thomson sued the government of New Zealand for failing to set emissions targets that reflect the scientific consensus on climate change and lost.

Rhode Island Government filed a complaint in Providence/Bristol County Superior Court to sue oil companies over the effects of climate change, seeking damages for the costs associated with protecting the state from rising seas and severe weather. Rhode Island is seeking compensatory damages, equitable relief (including abatement of nuisances), punitive damages, disgorgement of profits and costs.

In 2015, Luciano Lliuya, who had never left his country, Peru, traveled 6,500 miles to file a lawsuit against RWE, Germany’s largest energy utility. The lawsuit claimed that the company, though it does not operate in Peru, had contributed about half of 1 percent of the emissions that are causing the global climate to change and that it should therefore be responsible for half of 1 percent of the cost of containing the lake that might destroy Luciano Lliuya’s house. His claim entered the courts in the form of a demand for $19,000.[v]

There are notorious examples of public protest in Russia against air pollution from landfills. Little can be done as all the permissions from the government are in place.

Claims for environmental damages, especially climate change damages, need expensive and profound legal expertise to support them. Most often they are dismissed at early stages and even if not, difficult questions have to be explored. What is the chain of and where exactly does responsibility lie? How do we price the liability? How should other contributors to climate change liability be considered?

Once again, it is one of the main starting points, that from the economic point of view, the cause, the source, “the quantum” of negative external environmental impact is a transition, for-profit value exchange activity, and the parties to the deal are liable.[vi] While production of goods and services brings social benefits including positive externalities, for profit trading of values has profits (“making money”) as sole or major purpose and motive. These profits probably should be balanced by ‘internalization of externalities’ and both parties that enter investment, acquisition, financing deal directly or at the commodity or security exchanges are conscious of the consequences and of the risk that they may be held liable.[vii] Creditor and investors may be less aware of liability than those who directly produce emissions but the cause for growth of emissions still are the transactions. Those transactions might be unilateral, when a corporation takes unilateral self-financed investment decision.

Parties to climate change litigations may rely on public trust doctrine, lost grant doctrine, human rights doctrine, even on the concept of the rights of the planet or natural object as arguments. Ronald Coase provided formidable argument on reciprocity of the damage with regards to the increase of the cost of production for the manufacturer if he is limited in his rights to manufacture and to use common resources. The issue becomes easier to deal with if we focus on new sources.

While it is in fact difficult to define liability of the parties to particular transaction in terms of money, the least that can be done is full and excessive offsetting of the new sources and new GHG emissions caused by the deal. Famous Offset policy in the US launched in 1976 that required 1 to 1.2 offsetting of new emissions is a good example of successful implementation of such approach.

Notorious examples, where new emissions and consequential damages are not offset or compensated and are not intended to be offset are numerous and include:

- The Papua New Guinea Liquefied Natural Gas Project (Exxon – project financing institutions, off-takers from China, Taiwan etc.) for years has been generating greenhouse gas emissions of more than 3 million tCO2e per annum.[1] It is generally considered as a good and relatively environment friendly project with the exception that huge growth of emission (at least 90 million tCO2e for project cycle) is not offset and is not intended to be offset, as are not compensated related damages;[2]

- Chevron – Anadarko Petroleum merger and acquisition deal shall cause increase of oil export (and consequently of GHG emissions) to eight million from two million barrels a day in 2020 (roughly up to 3-4 million additional tCO2e) a year;

- The Makhado Project (MC Mining – undisclosed off-taker) with annual new coal production projected at 4-6 million t (around 11,4 – 17,1 million tCO2e per year).

The process of environmental impact assessment (EIA) and of monitoring, reporting and verification (MRV) of negative and positive impact should be demystified. The amount of new emissions to offset is easily quantifiable and should be independently verified and monitored preferably by trusted hard and software, IoT devices with the data, telemetry broadcasted to public immutable data storage.

The integrity of the semantic space the parties are operating in is important[3] and includes the requirement that EIA/MRV data should be placed in the very same public blockchain space the initial claim takes root, that the mitigation instruments should be originated in the same environment, i.e. in blockchain, not someplace else, and the offsets and offset providers should be identifiable and trackable within this semantic space. DAO “The Integral Platform for Climate Initiatives” provides a unique working tool to verify and issue mitigation/adaptation instruments on public blockchain and for integration with IoT devices for monitoring/verification purposes.

But even if we focus on new sources there still remains huge consequential damage, for example related to extraction, processing, transportation of hydrocarbon fossil fuels, destruction of landscapes, nuisance et cetera et cetera. Two methodological approaches might be proposed to simplify the task of evaluating such consequential damage. The first is to apply certain factor to the volume of emissions that represent direct harm. For example, if we apply factor equal to 1 and the respondent is offsetting 100 tCO2e at $1000 USD, his liability for consequential damage would add $1000 USD more in payments to the claimants. The second is to provide a bargaining tool for the parties to agree on peer-to-peer basis.

Filing a case and enlisting a claim against the parties to the deal or relevant authorities in blockchain is a way to seek settlement or court award as a last resort in a peer-to-peer and transparent way. Primary individual claim might be supported by secondary claims and by contributions of considerate members of global community ‘leveling the field’ for the parties.

The task that we are working on is to put environmental claims for damages on blockchain for peer-to-peer settlement or litigation as a last resort.

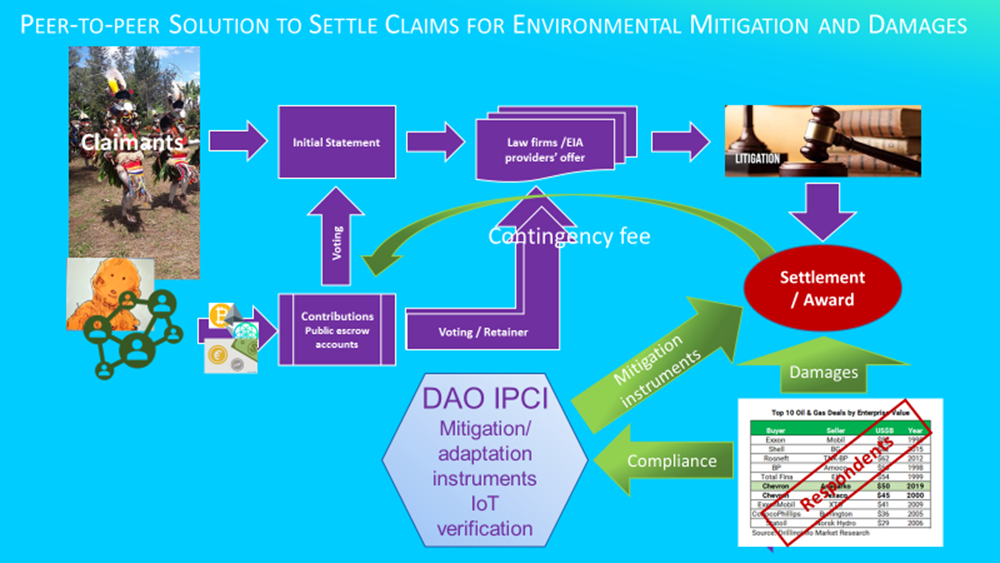

Proposed logic for the protocol:

- Claimant (e.g. climate change vulnerable community) files initial statement defining the respondents, the cause for action, the approximate amounts of mitigation/adaptation instruments and damages sought;

- Supporters (Contributors) make contributions in any currency (converted via CHF or DAI) and receive voting token equal to square root of a contribution to make numerous small contributions relatively more valuable. Contributions are collected at the public secured account (multi-signature of Congress) or to the common account controlled by all of the contributors through voting;

- At this point Contributors may start voting for the cases (initial statements) making potential material capacity of the case to stand visible;

- This is the earliest point, where the Respondents may settle;

- In parallel

- law firms interested in the cases file their offers for specific cases with details of the offer not necessarily disclosed to the public;

- the issuers (mitigation or adaptation instruments; providers) offer, verify and issue mitigation (adaptation) instruments (carbon credits, etc.);

- environmental impact assessment (EIA) and MRV providers file their offers with reference to particular cases;

- This is the earliest point where the Claimant may accept the law firm offer and receive the funds allocated through voting

- Supporters vote for the law firms’, EIA/MRV providers’ offers and for the consequential damage factor to derive the figure for consequential damage from quantifiable and verifiable volume of direct emissions , effluents etc.;

- The Claimant and the winners mutually accept offers and the results of voting and receive the funds collected to lead actual litigation. The details of the law firm offer may be kept undisclosed but to receive contributions the retainer of a professional legal advisor should be secured ;

- The claim, award or settlement should typically consist of two parts: a) in-kind compensation (mitigation/adaptation instruments, e.g. carbon credits) and d) damages

- Defendants buy out and burn mitigation instruments

- Damages (monetary compensation) return to the Congress to form a fund for further actions and/or are distributed in accordance with the award.

Direct bargaining and settlement between the parties is made possible until the final award. The more options for such direct interaction the application provides the higher are the chances for settlement.

The initial version for beta-testing though with real case would be simplified but contain all the critical elements:

The initial version for beta-testing though with real case would be simplified but contain all the critical elements:

- Filing of the original statement by the Claimant

- Acceptance of contributions in ETH, [MITO], DAI in exchange for voting token [and contribution token]

- Filing of simplified law firm offer

- Voting for the offers [in exchange for contribution token]

- Transfer of contributions to the winners [or proportionately to the votes]

- Settlement by the Respondent: burning of carbon credits and paying damages to the Claimant

The question of contingency fee is a tricky one and if we introduce it, the contributors would entitle to the part of it in proportion to the votes for specific case or to overall contributions but the token representing the contribution would then definitely be considered as a security token with all the implications of presumption of guilt and costs, burdens and liabilities imposed by regulators. On the other hand, the scheme with a contingency fee simplified format would be entirely applicable for virtual investment fund whereas the case may be substituted by positive impact project. And here comes the second solution.

Solution two: Decentralized positive impact fund

The topic of positive impact activities, “socially and environmentally responsible” activities is gaining popularity, partially because in this case Pigouvian taxes or administrative regulations also do not work quite as expected.

Putting the project onto public blockchain or launching a fund on the form of a decentralized autonomous organization is not something new. The task is to create trusted peer-to-peer semantic space for the agents to interact without interference of self-appointed authorities, mentorship, centralized interventions and preclude fraud and manipulations.

In the ideal case the entirety of information should be provide in the cases (projects presented), which is impossible especially for the projects related to natural environment, climate change.

As described in one of the previous papers,[viii] with climate change example, we would have to recognize the fact that, on the one hand, the fundamentals are long-term physical and chemical processes on our planet, while on the other, to make anything change in terms of economic activity you cannot do without microeconomics. What sort of academy of sciences, central authority, commission, or association would be able to comprehend all the necessary knowledge entirely?

Suggestion here would seem quite evident: we need some form of decentralization that would integrate fundamental scientific knowledge with dispersed specific knowledge on the level of microeconomics within one pattern. That’s where prices come in.

This might sound immoral or cynical but for the issues of the level of complexity we are discussing, there is just no other option to integrate the knowledge than prices, except for “political will and power” which would really mean coercion and manipulation by the establishment. “Fundamentally, in a system in which the knowledge of the relevant facts is dispersed among many people, prices can act to coordinate the separate actions of different people in the same way as subjective values help the individual to coordinate the parts of his plan”.[ix]

Prices essentially communicate information. They bring the information necessary for decision-making to a minimum and solve the problem of integrating knowledge on complex issues. However, the more rigid is the pricing system the less efficiently it performs this function. In the example of climate change issue, carbon tax rather communicates the aspirations of the governments than reflects the entirety of information needed for the businesses to make adequate decisions. Sometimes it leads to paradoxes, when introduction of carbon tax results in growth of GHG emissions. Experience shows that even carbon markets, when rigidly controlled by the governments do not provide expected incentives to “make the individuals do the desirable things without anyone having to tell them what to do”.[x]

The contributions/voting mechanism analogue to the one described in previous section might be used to create the desired pricing mechanism and broadcast pricing information within the sematic space we create.

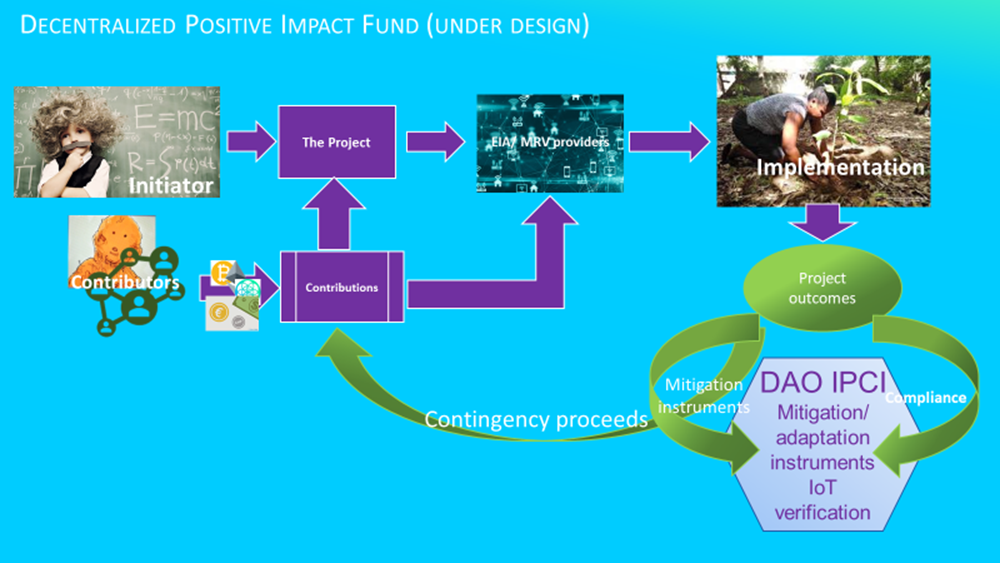

The basic model for decentralized positive impact fund suggests filing a project on public blockchain by the Initiator, filling offers to support the project with independent impact assessment and MRV system by independent entities, crowdfunding through contributions and quadratic voting, return of the contingency proceeds to the contributors.

Proposed logic for the protocol (much similar to the one in the previous solution):

- Initiator (individual, community, any physical or legal entity) files initial description of the proposed project defining entitlement or tenure or access for necessary resources (means), property, the cause and goals for project activity (ends), definition of the outcomes to be verified and tokenized within the same semantic space, i.e. DAO IPCI, the approximate amounts of monetary and in-kind contributions sought;

- Supporters (Contributors) make contributions in any currency (converted via e.g. CHF or DAI) and receive voting token equal to square root of a contribution to make numerous small contributions relatively more valuable, and a contingency proceeds token, which actually performs functions of a positive impact token. Contributions are collected at the public secured account (multi-signature of Congress) or to the common account controlled by all of the contributors through voting;

- At this point Contributors may start voting for the projects (initial project ideas thus making the pricing information however limited visible;

- Impact assessment and MRV providers file their offers with reference to particular projects;

- Contributors vote for EIA/MRV providers’ offers;

- The Initiator and the winner EIA/MRV provider mutually accept offers and the results of voting and receive the funds collected to launch the project activity. To receive contributions the retainer of a trusted EIA/MRV independent provider should be secured;

- Contingency project proceeds may typically consist of two parts: a) in-kind verified outcomes (mitigation/adaptation instruments, e.g. carbon credits, removals) and d) monetary proceeds, both of which the contributors are entitled to receive proportionately to their contributions or votes.

Just like with the solution one beta-testing of the simplified version with real projects to refine the model and to select options, for instance, the mechanism of return of the proceeds would be required.

Just like with the solution one beta-testing of the simplified version with real projects to refine the model and to select options, for instance, the mechanism of return of the proceeds would be required.

For the pilot projects to be supported with this model, sustainable forestry projects in West Africa (TreeChain), Papua New Guinea (T4G) may be proposed.[xi]

Numerous project need support but to be specific similar to Africa Green Wall project activity the efforts to protect farms and villages from the desert in the Aral Sea region deserve global community support.[xii]

[1] PNG communities would put forward at least 13 cases right a way demanding offsetting of emissions from new sources had they the capacity to do so

[2] https://pnglng.com/Environment

[3] Anton Galenovich, On Peer-to-Peer Solution to Common Resources, Social Costs and Consequential Environmental Damages Problem, https://medium.com/@antongalenovich/on-peer-to-peer-solution-to-common-resources-social-costs-and-consequential-environmental-damages-8049a21c8c5e

[i] “The immediate aim in playing a game is to defeat the partner according to the rules of the game. This is a peculiar and special case of acting. Most actions do not aim at anybody's defeat or loss. They aim at an improvement in conditions.” HUMAN ACTION. A Treatise on Economics, BY LUDWIG VON MISES, © 1998 by Bettina Bien Greave, p.471

[ii] “Passionarity” (from Latin passio, passion), the term introduced by Russian ethnographer and historian Lev Gumilev to signify the ability for and urge towards changing the environment, both social and natural, or, physically speaking, towards the disturbance of inertia of the aggregative state of an environment

[iii] “Posse” (Latin), to be able, can; to have power

[iv] Climate change litigation: A new class of action, White & Case, https://www.whitecase.com/publications/insight/climate-change-litigation-new-class-action

[v] https://www.nytimes.com/interactive/2019/04/09/magazine/climate-change-peru-law.html

[vi] https://medium.com/dao-ipci/damages-3e5a817f1c6e

[vii] For instance Chevron is aware and acknowledges “the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions” in the Anadarko deal, https://www.chevron.com/stories/chevron-announces-agreement-to-acquire-anadarko

[viii] https://medium.com/@antongalenovich/decentralized-solution-for-pricing-the-priceless-cd781746acdc

[ix] Hayek, Friedrich A., “The Use of Knowledge in Society.” 1945. Library of Economics and Liberty. 29 May 2018. http://www.econlib.org/library/Essays/hykKnw1.html, https://medium.com/@antongalenovich/decentralized-solution-for-pricing-the-priceless-cd781746acdc#_ftn1

[x] Op. cit. https://medium.com/@antongalenovich/decentralized-solution-for-pricing-the-priceless-cd781746acdc#_ftn2

[xi] https://medium.com/@antongalenovich/sustainable-forestry-in-dao-ipci-blockchain-model-and-token-design-494baef6d4ae

[xii] https://www.tol.org/client/article/28375-can-saxaul-save-the-aral.html

[i] “Yes, I can!” (Latin)