02.16.2019

The transaction-based approach to the settle damages of economic activities is in much like zero-revenue taxes whereas the proceeds are distributed among the taxpayers. But there still is a problem as we cannot predict where exactly the taxes shall go next year until we see the budget and subject to our trust that it is going to be executed.

There is something repulsive about taxes just like about any violence and extortion unless one feels quite confident in those who control the budget. I could understand paying to the men in the army or law enforcement structures for them to be sure in their future and to feel socially secured and not be disappointed, or for health protection as only God knows what and when might happen to one’s health.

But forcing everyone to pay, for instance, for GHG emissions while by far not everyone supports climate change mitigation neglecting complex negative impact of extraction and combustion of fossil fuels, just does not seem right.

In this context the proposed approach looks much preferable.

The brilliant ideas brought forward by Glen Weyl, Vitalik Buterin, Zoë Hitzigon liberal radicalism, quadratic voting, Harberger taxes in a book, blog and paper and developed further, look much more applicable to the issue of social costs in the Coase interpretation than to private property in general. If we interpret the rights to economic activity that is harmful to the third party as a limited resource, a factor of production, the distribution of the resource to those who attribute the most value to it seems impeccable.

The design of the experiment to check the approach in the previous paper might be more practical if applied to real-life case use-case under implementation in public blockchain, specifically to Papua New Guinea Travel4Good Project (PNG T4G).

We may wait forever until fossil fuels or cryptocurrencies’ traders would risk a portion of their assets to be locked until settlement is reached based on the proposed model, whereas with PNG T4G we have the complex negative impact, the offset providers, the third party seeking compensation and the traders, buyers and sellers, who might want to compensate damages arising from their transactions.

The fundamental assumption remains the same: in the context of the economic approach indivisible elementary particle, a quantum of negative impact is generated in a particular transaction, a deal, be it sale of air traveling ticket, or a bank loan to the oil company, or an operation at the commodity exchange.

PNG T4G design has been completed in the first instance and the White paper has just been made public for public review and comments.

The Project encourages the travelers to offset their carbon footprint by REDD+ offsets, carbon removal credits providing support to sustain indigenous forests. Unlike most of other carbon offsetting programs the project is implemented on peer-to peer basis, when one does not have to trust any fund, authority, green NGO, or any other intermediary imposed but proceeds with transactions directly to those who own and manage the forests on site with MRV developed on IoT-based devices.

The negative impact of GHG emissions and positive impact of sustainable forestry are complex and are accounted for in quantified and verified Carbon Removal Credits and T4G tokens representing not any sort of ownership for the land and forests but contributions of the stakeholders to the project ends. Initial emission of the T4G token is rigidly linked to the area of sustainable forestry with 60% of the stake fixed for the Incorporated Land Groups (ILG), customary landowners of the forest lands. Thus, 60% of the proceeds from the travelers who buy and retire Carbon Removal Credits are assigned to the customary landowners.

It would be reasonable for the sellers to participate in the settlement (in the T4G Project case those are air operators and hotels in the first place). The air companies may argue that they comply with regulations imposed by their relevant jurisdictions or ICAO and are not liable, though those institutions are outside of the semantic context of the program and therefore irrelevant.

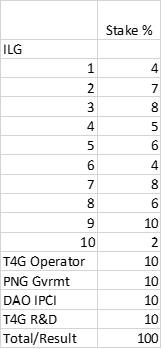

At the first stage the scheme is straightforward with the travelers voluntary offsetting their carbon footprint and the proceeds distributed among stakeholders in direct correlation with their contribution. For example, in the table below we have 10 ILG with different areas of forest under management with total contribution equal to 60% and other contributions of Government supporting authorities, R&D team, program operator:

As negative impact of human induced climate change is complex, part the 60% stake is targeted at adaptation, humanitarian and repatriation, supporting future generation measures implemented via local communities.

For the reference, there are about 29 million hectares of forested land in PNG, these includes rain-forest, woodland, Savannah and scrub. Out of this figure, the production forest area has been estimated to be 21.3 million hectares and 8.4 million hectares is under forest concession for economic development while 12.9 million hectares is future potential production forests to date. Production forests areas are comprised of high-quality tropical hardwoods and other forest products and are major export revenue source for PNG. Forests in Tambul-Nebilyer district comprised a portion of the 12.9 million, the forest area the T4G will initially go into offsetting sinks/removals. It’s estimated to be 3.1 million hectares of potential forest production in Tambul Nebilyer district. Between 2014 and 2015, reductions of emissions from prevention of deforestation and forest degradation estimated to be 9,003,314 tCO2 equivalent. By the rule of thumb, for the 3.1 million hectares forested land in Tambul-Nebilyer, Carbon Removal Credits number is 962,423 tCO2. It goes without saying that action issuance of these offsets is possible only through verification or based on a security deposit sufficient to substitute the potential lack of verified offsets.

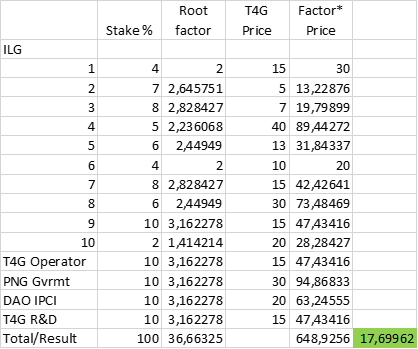

At the same time of at the next stage we might want to consider accepting external contributions to support the program. It would be achieved via additional emission of T4G tokens representing contributions. First, we would have to determine the price for T4G token via quadratic voting of the stakeholders. In the table below is a hypothetical example of such voting with the price range from 5 to 40 in the agreed currency:

The result in this hypothetical example would be 17,7 (in green).

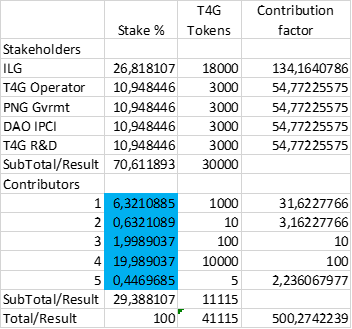

With this price the new contributors may be accepted, and their respective contributions accounted for under similar formula that provides for fair distribution of the proceeds. In the table below is an example with five contributions ranging from 5 to 10,000 and the resulting stakes (in blue) in the proceeds coming from the sales of offsets:

The distribution of proceeds in this case would have to go from the number of tokens-based to the variable stakes-based and numerous small contributions would weigh relatively more than a few large ones.

I hope that this practical experiment with the ideas and approaches described would be interesting for the very different communities, including blockchain, economics and climate change, environmental communities.